santa clara property tax due date

Learn all about Santa Clara County real estate tax. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020.

Secured Property Taxes Treasurer Tax Collector

I cant move the dates.

. The payment for these bills must be received in our office or paid online by August 31. Taxes due for July through December are due November 1st. Your Santa Clara property taxes are due in two installments per year.

The forms should be submitted after April 10. Free viewers are required for some of. Whether you are currently a resident just thinking about taking up.

If the due date on the bill falls on Saturday Sunday or a County holiday payments must be made the next business day to avoid penalties. There appears to be a lag regarding deaths because they need to do an autopsy to prove the death the latest records show 6 deaths in the week of dec 11 to 16 in santa clara county before the. Property tax due date.

Enter Property Address this is not your billing address. Property owners who cannot pay at this time can request a penalty cancellation online. Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square.

Santa Clara County Property Tax Rates The average effective property tax rate in Santa Clara County is 073. Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

Even for Californian standards a median property tax bill of over 6600 is punishingly high. 1500 Warburton Ave Santa Clara CA. Best answer for this question how do you calculate property tax in California.

Appealing your property tax appraisal. Unsecured Property annual tax bills are mailed are mailed in July of every year. Thats not because our local tax collectors are unsympathetic.

The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll. What Are the Due Dates for Property Tax in Santa Clara County. According to officials who spoke with us about the looming deadline they just cant do a damn thing about it.

12345678 Enter Account Number. Please contact us at. A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 125.

If not paid by 500PM they become delinquent. 70 W Hedding StThe Santa Clara County Assessors Office is located in San Jose California. Multiplying the Santa Clara County tax rate by your propertys assessed value gives you your property tax amount.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. I dont have the authority to cancel or delay property taxes said Margaret Olaiya director of the Santa Clara County Department of Tax and Collections. This incorporates the base rate of.

April 10 What if I cant pay. SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

The first installment is due on Nov. Payments are due as follows. SANTA CLARA COUNTY CALIF.

Business Property Statements are due April 1. Santa clara countys due date for property taxes is what it is. December 10 last day to pay first installment without penalties.

San Jose is the county seat of Santa Clara County where most local government offices are located. Checking the Santa Clara County property tax due date. 16 rows Assessed values on this lien date are the basis for the property tax bills that are due in.

The taxes are due on August 31. Santa Clara County Property Tax Due Date 2022. The assessors office is located in the same building as the.

Santa Clara Countys due date for property taxes is what it is. If you pay after 5 pm. Municipal Services Business Tax License.

And its still April 10. The fiscal year for Santa Clara County Taxes starts July 1st. Gross receipts and compensating tax rate schedule effective january 1 2022 through june 30 2022 a a b b b.

You can also make partial payments until your balance is paid in full but the full balance needs to be paid by June 30. The due date to file via mail e-filing or SDR remains the same. On Monday April 11 2022.

With the help of this guide youll receive a useful insight into real estate taxes in Santa Clara and what you should take into consideration when your propertys appraised value is set. Doing Business As. October 19 2020 at 1200 PM.

This date is not expected to change due to COVID-19 however assistance is available to. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment.

Property Tax Overview Linda Santillano Property Tax Manager Ppt Video Online Download

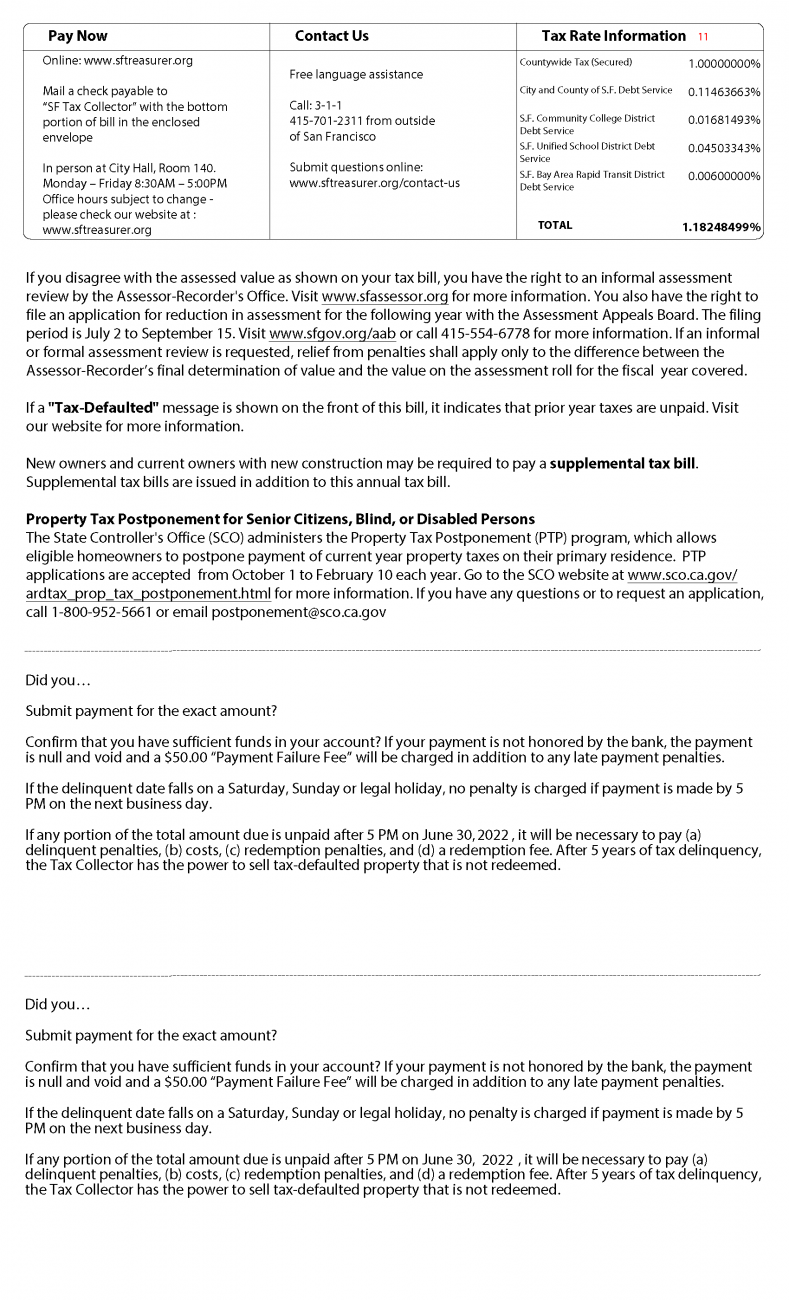

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Understanding California S Property Taxes

Business Property Tax In California What You Need To Know

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Cook County Property Tax Bills May Be Delayed By Inter Office Controversy Abc7 Chicago

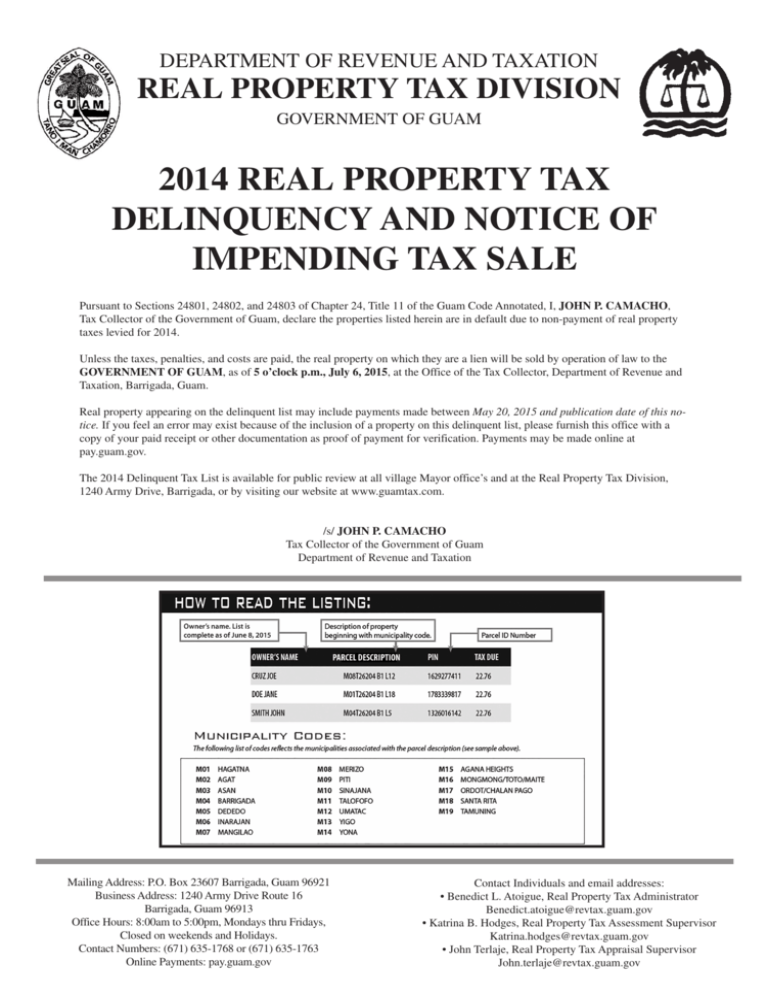

2014 Real Property Tax Delinquency And Notice Of Impending Tax

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Overview Linda Santillano Property Tax Manager Ppt Video Online Download

Secured Property Taxes Treasurer Tax Collector

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Property Taxes Department Of Tax And Collections County Of Santa Clara

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post